Introduction

Monetary proficiency training is essential in giving people the information and abilities they need to settle on informed financial choices. From overseeing individual accounting records to understanding FICO assessments, monetary proficiency furnishes individuals with the instruments to explore the intricacies of the cutting-edge economic scene.

Understanding Personal Finance

At the center of monetary education is understanding individual accounting ideas, for example, planning, saving, financial planning, and obligation to the executives. Assuming control of crucial financial standards enables individuals to steer their monetary prospects toward their desired objectives.

Building a Strong Financial Foundation

Effective money management lays the groundwork for financial stability and success. By developing good financial habits and making sound financial decisions, individuals can build a strong foundation for long-term financial security and wealth accumulation.

Benefits of Effective Money Management

The benefits of effective money management are far-reaching. From reducing financial stress and anxiety to achieving financial goals and dreams and dominating cash, the executive’s abilities can work on general personal satisfaction and prosperity.

Exploring Financial Literacy Resources

Online Courses and Tutorials

The Internet offers a wealth of financial literacy resources, including online courses and tutorials. Platforms like Coursera, Udemy, and Khan Institute give admittance to courses covering many monetary points, from essential planning to cutting-edge money management methodologies.

Books and Publications

Books and distributions are another significant wellspring of monetary training. Bestselling authors and financial experts share their insights and expertise on topics such as personal finance, investing, and wealth building, making financial literacy accessible to all.

Educational Websites and Apps

Educational websites and apps cater to individuals seeking to improve their financial literacy. Websites like Investopedia and NerdWallet offer comprehensive guides and articles on various financial topics. At the same time, apps like Mint and YNAB help users track their spending, set budgets, and manage their finances effectively.

- Enrolling in Personal Finance Courses

Curriculum Overview

Courses on personal finance aim to cover a broad spectrum of subjects, including budgeting, saving, investing, and retirement planning, among others. These courses intend to provide an extensive summary of financial concepts and principles that are suitable for people of all ages and backgrounds.

Learning Objectives

The primary objective of personal finance courses is To provide individuals with the necessary information and abilities. Make sound financial decisions. By the end of the course, participants should have a solid understanding of key financial concepts and be able to apply them to their financial situations.

Practical Applications

Personal finance courses often incorporate real-life case studies, interactive exercises, and practical applications to reinforce learning. Participants have the opportunity to apply what they’ve learned to their financial situations, gaining hands-on experience in managing money effectively.

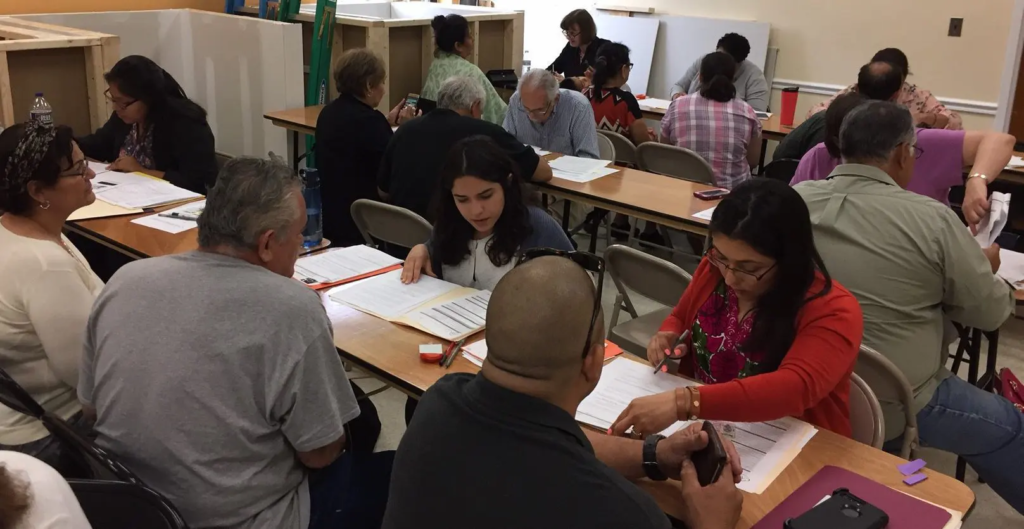

- Participating in Financial Education Programs

Workshop Formats

Financial education programs often take the form of workshops, seminars, or webinars. Participants can avail the chance to gain knowledge through these programs. Financial experts and industry professionals in a collaborative and interactive environment.

Guest Speakers and Experts

Guest speakers and experts are frequently invited to financial education programs to share their insights and expertise on specific financial topics. These sessions provide participants with valuable knowledge and perspectives from industry insiders.

Interactive Learning Activities

Financial education programs may include interactive learning activities such as group discussions, case studies, and role-playing exercises. These activities encourage active participation and engagement, enhancing the learning experience for participants.

- Mastering Budgeting Workshops

Budgeting Fundamentals

Budgeting workshops focus on teaching participants that learning the basics of budgeting is essential. This includes knowing how to devise a budget plan, record expenses, and monitor spending. Set financial goals. Participants learn practical strategies for managing money effectively and making informed spending decisions.

- Creating a Personal Budget

Participants in budgeting workshops learn how to create

A personal budget tailored to their individual financial goals and priorities. They gain practical skills for allocating income, managing expenses, and saving for the future.

Ways to adhere to a Financial Plan

Adhering to a financial plan may be troublesome; however, it very well may be accomplished with legitimate methods and self-control. Planning studios furnish members with tips and methodologies for keeping focused. From keeping away from motivation buys to tracking down cash-saving tips, members figure out how to beat regular planning traps and make monetary progress.

- Understanding Credit Score Improvement

Importance of Credit Scores

FICO ratings assume an essential part in monetary well-being, well-being, and prosperity. Banks use FICO ratings to evaluate financial soundness and decide financing costs on advances and Mastercard’s. A higher FICO rating can prompt lower getting costs and more noteworthy monetary open doors.

Factors Influencing Credit Scores

Several factors influence credit scores, including payment history, credit utilization, length of credit history, new credit accounts, and types of credit used. Understanding these factors is essential for improving credit scores and maintaining good credit standing.

Strategies for Improving Credit Scores

Improving credit scores requires a combination of responsible credit management and financial discipline. Strategies for improving credit scores include:

- Making on-time payments.

- Reducing credit card balances.

- Avoiding new credit inquiries.

- Monitoring credit reports regularly.

- Conclusion

Monetary proficiency training is an integral asset for giving people the information and abilities they need to make financial progress. By dominating cash-the-board skills, signing up for individual budget courses, partaking in monetary training projects, and comprehending how to improve their FICO rating, people can have power over their financial futures and build a strong base for long-lasting economic prosperity.

FAQs

1. What are the benefits of improving financial literacy?

– Improving financial literacy can lead to reduced financial stress, better money management skills, increased financial confidence, and improved overall economic well-being.

2. How can I find reliable financial literacy resources?

– Reliable financial literacy resources can be found through online courses, books, educational websites, and apps and reputable financial institutions and organizations.

3. What themes are covered in individual budget courses?

– Individual accounting courses cover many subjects, including planning, saving, effective money management, retirement arranging, obligations to the executives, and monetary objective setting.

4. How do financial education programs differ from traditional schooling?

– Financial education programs focus on teaching individuals practical money management skills and financial concepts. In contrast, traditional schooling typically provides a broader academic curriculum.

5. What steps might I, at any point, assume to develop my praise score further?

– To further develop your financial assessment, center around making on-time installments, lessening Mastercard adjusts, staying away from new credit requests, and observing your credit report consistently for mistakes or errors.